Research Article - Clinical Practice (2018)

Insurance Health companies of a southern region of Colombia: Company behavior and survival 2012-2016

- Corresponding Author:

- José D. Charry

Research Department

Fundación Universitaria Navarra-Uninavarra, Colombia

E-mail: danielcharry06@gmail.com

Abstract

This article describes the behavior of insurance health companies registered during 2012 to 2016, from the state of Huila - Colombia. A retrospective observational descriptive study was performed; the source of information was a national database “Registro Único Comercial y Social - RUES”; taking into account only registered health insurance companies, their economic activity, size and location. It was found an inverse association between company size and survival, and a direct association between size and number of companies that are registered under a specific economic activity. This information can be useful for future projects, strategies, interventions for new and established health insurance companies.

Keywords

business success, health companies, health sector, business behavior

Introduction

Social ministry of Colombia has changed the health system significantly and also the structure for health workers. Before the Law 100 of 1991, there were three subsystems: social security, public and private health [1].

The social security included the Social Security Institute (SSI), which provided its service throughout the network of public hospitals, and the private subsystem which covered groups that had prepaid or private medicine plans [1-2].

Law 100 of 1993 incorporated a new competition based schemes which regulated market and price mechanisms with the goal of increasing coverage, improving efficiency / quality of services, throughout the adoption of an obligated health insurance plans and a regulated competition scheme [3].

These changes in the health system allowed the creation of the Health Promoter Companies (HPC), the outsourcing of the health service to the Health Care Institutes (HCI), leading to formation of the Small and Medium companies. Although this reform has influenced the formation of many small and medium size companies [4], this puts a big uncertainty for survival in the market National.

Several studies, in different countries, show that 50% or more of those companies created can survive for at least five years [5-7]. In fact, in OECD countries, about 20-40% of new firms leave their operation within the first two years of life and only 40 to 50% survive beyond the seventh year [8,9]. There are various factors that determine the company survival: economic environment and capacity to innovate [10-15], growth rate, size and age of companies [16-20], level of concentration and reactibility to market changes [21,22] and making strategic decisions [23,24].

In Latin America there are a similar behavior, according to the national association of commerce of Latin America survival for companies is defined when 50% or more of those companies created can survive for at least five years. In Colombia only forty percent remain open [25] evidencing that a low company survival [7,26].

However, in Colombia the determinants for company survival are not clear. There have been made several studies about company survival in certain cities of Colombia [27-29], but most of them excludes health companies and have not reached to solid conclusions [30], and have very singular inclusion criteria [31]. Although these studies have established a baseline in Colombia, they cannot be considered current since economic conditions change rapidly over time.

Regarding the health sector, the dynamics of these companies are not yet established. Therefore, the objective of this study is to describe the survival factors of health companies that were included in the National Market Register between 2012 to 2016 in a southern state of Colombia.

Methods

A retrospective observational descriptive study was performed; the source of information was a national database “Registro Único Comercial y Social - RUES”; taking into account only registered health insurance companies between 2012 to 2016, their economic activity, size and location.

Data analysis was restricted to companies with a legal status and registered under human health care and social assistance as their main economic activity. The analysis was performed for the Uninavarra Research Center team using the statistical program IBM-SPSS® 23 version.

Central tendency and dispersion measurements were used for the quantitative variables; in addition, bivariate analysis was performed to correlate economic activity, size and location. Various statistical confidence tests were applied, such as spearman Rho and Chi2 (x2).

Inclusion and exclusion criteria

Company creation date was determined with the registration database and company death whenever it disappear from database, that could be for cancellation of the registration or due to no new updates of its registration in the following years. Every missing data information of the companies was not considerate for de study.

Results

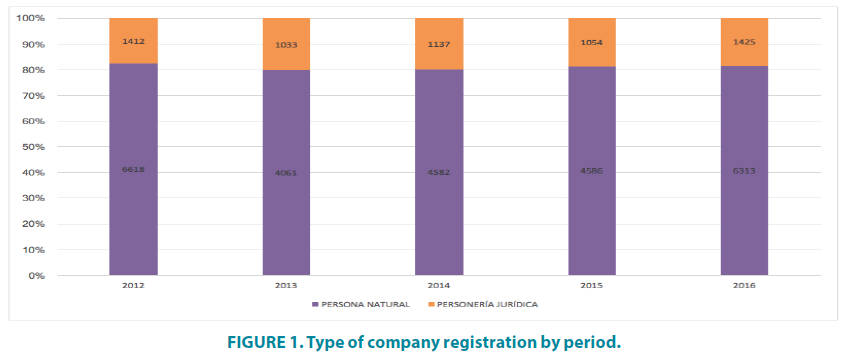

Between 2012 to 2016 a total of 51 114 companies were registered, 63.04% of those were subscribed for a natural or legal person. From these productive units 18.81% were legal entities, and the constitution average was 18.97%, with constitution means ranged between 17% to 20% (FIGURE 1).

For the period of 2016 a total of 72.61% of companies were found registered and with an updated commercial register. Between 2012 - 2015 period 64.19% (n =2 976) updated their commercial registry, conforming 67.62% of the total active companies for 2016 (TABLE 1).

| Registration year | Registered | Renewed and registered in 2016 |

% renewed and registered in 2016 per period |

% renewed and registered to 2016 on the total |

|---|---|---|---|---|

| 2012 | 1412 | 586 | 41.50% | 13.32% |

| 2013 | 1033 | 687 | 66.51% | 15.61% |

| 2014 | 1137 | 841 | 73.97% | 19.11% |

| 2015 | 1054 | 862 | 81.78% | 19.59% |

| 2016 | 1425 | 1425 | 100% | 32.38% |

| Grand Total | 6061 | 4401 | 72.61% | 100% |

Table 1. Updating of the merchant registry.

Data showed that during 2012-2016 the updating of the merchant registry was found to be inversely proportional with the time of creation. Updating for the first period companies was 41, 50% (n=586), for the second period 66,51% (n=687), for the third period was 73,97% (n=1137) and for the fourth was 81,78% (n=862) (TABLE 1).

During the study period, 67.94% of the companies registered were created in the northern región of the state, of which 71.78% were still active at the end of 2016, additionally presenting the lowest renovation rate compared to the other zones of the state, the other regions of the state presented different behavior (TABLE 2).

| Subregion | Registered | Renewed and Registered in 2016 |

% Registered | % renewed and Registered by area |

% renewed and registered with respect to the total |

|---|---|---|---|---|---|

| Center | 605 | 435 | 9.98% | 71.90% | 9.88% |

| North | 4118 | 2956 | 67.94% | 71.78% | 67.17% |

| West | 445 | 341 | 7.34% | 76.63% | 7.75% |

| South | 893 | 669 | 14.73% | 74.92% | 15.20% |

| Grand Total | 6061 | 4401 | 100% | 72.61% | 100% |

Table 2. Geographical distribution of companies registered during 2012 to 2016 periods among the state of Huila-Colombia.

At the end of 2016, 70, 32% of the companies registered had also another economic activity registered. The most common was other activities related to health care with 23.22%, wholesale trade in 14.7%, construction 11.27%, professional, scientific and technical activities 11-16% and agriculture, livestock, hunting, forestry and fishing 9.98%. The most common size of the companies related were the micro-companies, that corresponded to 92.84% (n=4,086) of the total (TABLE 3).

| Section | Description | Company size * | Total | Participation by sector (%) | |||

|---|---|---|---|---|---|---|---|

| Large | Medium | Micro | Small | ||||

| A | Agriculture, livestock, hunting, forestry and fishing | 4 | 421 | 12 | 439 | 9.98% | |

| B | Exploitation of mines and quarries | 40 | 2 | 43 | 0.98% | ||

| C | Manufacturing industries | 1 | 238 | 22 | 262 | 5.95% | |

| D | Water distribution; evacuation and treatment of wastewater, waste management and environmental sanitation activities | 1 | 48 | 51 | 1.16% | ||

| F | Building | 2 | 8 | 445 | 39 | 496 | 11.27% |

| G | Wholesale and Retail; repair of motor vehicles and motorcycles | 1 | 3 | 596 | 42 | 647 | 14.70% |

| H | Transportation and storage | 109 | 15 | 124 | 2.82% | ||

| I | Accommodation and food services | 112 | 6 | 121 | 2.75% | ||

| J | Information and communications | 118 | 118 | 2.68% | |||

| K | Financial and insurance activities | 58 | 3 | 62 | 1.41% | ||

| L | Real estate activities | 58 | 7 | 65 | 1.48% | ||

| M | Professional, scientific and technical activities | 1 | 478 | 9 | 491 | 11.16% | |

| N | Administrative and support services activities | 1 | 161 | 11 | 174 | 3.95% | |

| Ñ | Public administration and defense; compulsory social security plans | 35 | 1 | 38 | 0.86% | ||

| O | Education | 1 | 58 | 2 | 64 | 1.45% | |

| P | Human health care and social assistance activities | 1 | 1 | 140 | 12 | 154 | 3.50% |

| Q | Artistic, entertainment and recreation activities | 3 | 23 | 1 | 27 | 0.61% | |

| R | Other service activities | 945 | 4 | 1022 | 23.22% | ||

| T | Without activity | 3 | 3 | 0.07% | |||

| Grand Total | 4 | 24 | 4086 | 188 | 4401 | 100% | |

Table 3. Distribution of companies by size and economic sector.

About 45% of the companies from the health care and social assistance in the study period corresponded to a legal entity with an average of 45.61% of constitution per period. The lowest companies under this legal status (31%) were in the 2016 period, while the highest creation of companies of this type (57.50%) were the 2014 period (TABLE 4).

| Period | Person | Legal satus | Total firms | % person | % Legal status | % Legal status per period |

|---|---|---|---|---|---|---|

| 2012 | 46 | 36 | 82 | 11.00% | 8.61% | 43.90% |

| 2013 | 37 | 44 | 81 | 8.85% | 10.53% | 54.32% |

| 2014 | 34 | 46 | 80 | 8.13% | 11.00% | 57.50% |

| 2015 | 44 | 31 | 75 | 10.53% | 7.42% | 41.33% |

| 2016 | 69 | 31 | 100 | 16.51% | 7.42% | 31.00% |

| Grand total | 230 | 188 | 418 | 55.02% | 44.98% | 45.61% |

Table 4. Type of company registration by period.

During the study period 81.91% (n=154) of the registered companies renewed their registration title for the year 2016 with a mean of 78.43% between 2012 - 2015 periods (TABLE 5). The companies registered during the 2012 to 2015 periods also presented a similar average of renovation ranging between 82.58% and 84.78 (TABLE 6).

| Registration year | Registered | Renewed and Registered in 2016 |

% Renewed and Registered in 2016 per period |

% Renewed and Registered in 2016 |

|---|---|---|---|---|

| 2012 | 36 | 26 | 72.11% | 16.88% |

| 2013 | 44 | 33 | 75.00% | 21.43% |

| 2014 | 46 | 38 | 82.61% | 24.68% |

| 2015 | 31 | 26 | 83.87% | 16.88% |

| 2016 | 31 | 31 | 100% | 20.13% |

| Grand total | 188 | 154 | 81.91% | 100% |

Table 5. Company Registration and updating by period.

| Constitution period | Renewal Period | Average number of companies renewed | |||

|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | ||

| 2012 | 94.44% | 86.11% | 80.56% | 72.22% | 83.33% |

| 2013 | 88.64% | 84.09% | 75.00% | 82.58% | |

| 2014 | 86.96% | 82.61% | 84.78% | ||

| 2015 | 83.87% | 83.87% | |||

Table 6. Company register Updating by period.

Of the companies incorporated in 2012, 72.2% (n=526) renewed their registration in all periods of the study, 5.5% (n=2) did not renew in any period and 22.2% (n=8). They renewed in one of the periods described. The information discriminated from the behavior of the renewals by enrollment period is found in TABLE 7. Additionally, it was evidenced that the behavior of non-renewal of the registry increased exponentially period after period where in the first year it was 23.54%, 32.87 % for the second, 42.99% for the third and 58.50% for the fourth.

| Constitution year | Total companies incorporated | Continuous renewal | Without renewal | Some renovation |

| 2012 | 36 | 26 | 2 | 8 |

| 2013 | 44 | 33 | 5 | 6 |

| 2014 | 46 | 38 | 6 | 2 |

| 2015 | 31 | 26 | 5 | 0 |

| Total | 188 | 123 | 18 | 16 |

| Constitution year | % Continuous renewal | % Without renewal | % Some renovation | % Companies with renewal to 2016 |

| 2012 | 72.2% | 5.5% | 22.2% | 72.11% |

| 2013 | 75% | 11.36% | 13.63% | 75.00% |

| 2014 | 82.6% | 13.04% | 4.34% | 82.61% |

| 2015 | 83.87% | 16.13% | 83.87% | |

| Average | 78.42% | 11.51% | 13.39% | 78.40% |

Table 7. Company register Updating following creation.

Most of the companies from the 2012 group 72.2% (n=526) renewed their registration at all periods, 22.2% (n=8) updated their registration only for one period, and 5.5% (n=2) did not updated at any other period. Also, there was a relationship between time of registry and updating, where the oldest registries only renewed in 23.54%, 32.87 % for the second, 42.99% for the third and 58.50% for the fourth registry period (TABLE 7).

A total of 92.55% (n=174) companies were micro-companies in size. From those companies, 80.46% (n=140) remained in activities until the end of the 2016 period (TABLE 8).

| Size | Registration | % Registered companies | Active 2016 | % Active companies 2016 | % Companies renewed by size |

|---|---|---|---|---|---|

| Large Company | 1 | 0.53% | 1 | 0.65% | 100% |

| Medium Company | 1 | 0.53% | 1 | 0.65% | 100% |

| Micro Company | 174 | 92.55% | 140 | 90.91% | 80.46% |

| Small company | 12 | 6.38% | 12 | 7.79% | 100% |

| Grand total | 188 | 100.00% | 154 | 100% | 81.91% |

Table 8. Company register Updating by period by size.

The state region with the bigger number of companies registered as new was the north region with 77.13% of the total, and maintaining its representation in the number of active companies in 2016 with 78.57% of the total. The average turnover of companies in the other sub regions was 78.92% (TABLE 9).

| Subregion | Registration | % registered companies | Active 2016 | % companies renewed by sub-region | % active companies 2016 |

|---|---|---|---|---|---|

| Center | 8 | 4.26% | 6 | 75.00% | 3.90% |

| North | 145 | 77.13% | 121 | 83.45% | 78.57% |

| West | 12 | 6.38% | 10 | 83.33% | 6.49% |

| South | 23 | 12.23% | 17 | 73.91% | 11.04% |

| Grand Total | 188 | 100% | 154 | 81.91% | 100% |

Table 9. Company registration and updating by state subregion.

The registration of new companies for nonhospitalization health care remained constant over all periods of the study, with an average enrollment of 43.98%, followed by other activities of human health care 19.21%, and 11.32% for dental practice (TABLE 10).

| Economic activity | 2012 | 2013 | 2014 | 2015 | 2016 | Average registration |

|---|---|---|---|---|---|---|

| Activities of medical practice without hospitalization | 27.78% | 43.18% | 52.17% | 54.84% | 41.94% | 43.98% |

| Other activities of human health care | 30.56% | 15.91% | 10.87% | 19.35% | 19.35% | 19.21% |

| Activities of the dental practice | 13.89% | 11.36% | 15.22% | 6.45% | 9.68% | 11.32% |

| Diagnostic support activities | 8.33% | 13.64% | 10.87% | 3.23% | 9.68% | 9.15% |

| Therapeutic support activities | 11.11% | 11.36% | 4.35% | 3.23% | 12.90% | 8.59% |

| Generalized residential medical care activities | 2.78% | 0.00% | 4.35% | 0.00% | 0.00% | 1.85% |

| Other social assistance activities without accommodation | 0.00% | 4.55% | 0.00% | 3.23% | 0.00% | 1.55% |

| Activities of hospitals and clinics with hospitalization | 2.78% | 0.00% | 0.00% | 3.23% | 3.23% | 1.43% |

| Residential care activities for the care of patients with mental retardation mental illness and consumption of psychoactive substances | 0.00% | 0.00% | 0.00% | 6.45% | 0.00% | 1.29% |

| Other care activities in institutions with accommodation | 0.00% | 0.00% | 0.00% | 0.00% | 3.23% | 0.65% |

| Care activities in institutions for the care of the elderly and / or disabled | 2.78% | 0.00% | 0.00% | 0.00% | 0.00% | 0.43% |

| Social assistance activities without accommodation for the elderly and disabled | 0.00% | 0.00% | 2.17% | 0.00% | 0.00% | 0.56% |

| Grand Total | 100% | 100% | 100% | 100% | 100% |

Table 10. Company registration by period and economic activity.

The most part of the companies were related to basic health centers 74.47%, and the rest corresponded to other activities of human health care and dental practice. The largest portion of size companies were micro companies 92.55% (n=174), and its distribution corresponds, in the same order, with the activities of most common participation (TABLE 11).

| Economic activity | Large Company | Medium Company | Micro-company | Small company | Grand Total | Participation by activity |

|---|---|---|---|---|---|---|

| Diagnostic support activities | 15 | 3 | 18 | 9.57% | ||

| Therapeutic support activities | 14 | 2 | 16 | 8.51% | ||

| Social assistance activities without accommodation for the elderly and disabled | 1 | 1 | 0.53% | |||

| Care activities in institutions for the care of the elderly and / or disabled | 1 | 1 | 0.53% | |||

| Residential care activities for the care of patients with mental retardation mental illness and consumption of psychoactive substances | 2 | 2 | 1.06% | |||

| Generalized residential medical care activities | 3 | 3 | 1.60% | |||

| Activities of hospitals and clinics with hospitalization | 1 | 1 | 1 | 3 | 1.60% | |

| Activities of medical practice without hospitalization | 77 | 6 | 83 | 44.15% | ||

| Activities of the dental practice | 22 | 22 | 11.70% | |||

| Other social assistance activities without accommodation | 3 | 3 | 1.60% | |||

| Other activities of human health care | 1 | 34 | 35 | 18.62% | ||

| Other care activities in institutions with accommodation | 1 | 1 | 0.53% | |||

| Grand Total | 1 | 1 | 174 | 12 | 188 | 100.00% |

Table 11. Company registration by economic activity and size.

The 36.3% of the economic activities in the health care sector registered during all the periods were diagnostic support, therapeutic support, day care management of patients, and those related to the dental practice. As the periods are passing we found decreasing number of companies registered, for the 2012 period only 72% remained in activities in the 2016 period, and for the 2014 period around 80% remained in activities by the 2015 period (TABLE 12).

| Economic activity | Registered | % registered participation | Renewed and registered in 2016 | % renovated |

|---|---|---|---|---|

| Activities of medical practice without hospitalization | 83 | 44,15% | 71 | 85,54% |

| Other activities of human health care | 35 | 18.62% | 24 | 68.57% |

| Activities of the dental practice | 22 | 11.70% | 18 | 81.82% |

| Diagnostic support activities | 18 | 9.57% | 15 | 83.33% |

| Therapeutic support activities | 16 | 8.51% | 13 | 81.25% |

| Generalized residential medical care activities | 3 | 1.60% | 3 | 100.00% |

| Other social assistance activities without accommodation | 3 | 1.60% | 3 | 100.00% |

| Activities of hospitals and clinics with hospitalization | 3 | 1.60% | 3 | 100.00% |

| Residential care activities for the care of patients with mental retardation mental illness and consumption of psychoactive substances | 2 | 1.06% | 1 | 50.00% |

| Other care activities in institutions with accommodation | 1 | 0.53% | 1 | 100.00% |

| Care activities in institutions for the care of the elderly and / or disabled | 1 | 0.53% | 1 | 100.00% |

| Social assistance activities without accommodation for the elderly and disabled | 1 | 0.53% | 1 | 100.00% |

| Grand Total | 188 | 100% | 154 | 81.91% |

Table 12. Registered and updated companies for the 2016 period by economic activity.

For the 2016 period 73.37% of the companies were registered for medical practice without hospitalization, other activities of human health care and activities of dental practice (TABLE 13).

| Economic activity | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|

| Diagnostic support activities | 100.00% | 66.67% | 80.00% | 100.00% |

| Therapeutic support activities | 75.00% | 60.00% | 100.00% | 100.00% |

| Social assistance activities without accommodation for the elderly and disabled | 100.00% | |||

| Care activities in institutions for the care of the elderly and / or disabled | 100.00% | |||

| Residential care activities for the care of patients with mental retardation mental illness and consumption of psychoactive substances | 50.00% | |||

| Generalized residential medical care activities | 100.00% | 100.00% | ||

| Activities of hospitals and clinics with hospitalization | 100.00% | 100.00% | ||

| Activities of medical practice without hospitalization | 80.00% | 78.95% | 83.33% | 88.24% |

| Activities of the dental practice | 80.00% | 100.00% | 57.14% | 100.00% |

| Other social assistance activities without accommodation | 100.00% | 100.00% | ||

| Other activities of human health care | 45.45% | 57.14% | 100.00% | 66.67% |

| Grand Total | 72.22% | 75.00% | 82.61% | 83.87% |

Table 13. Company registered and updated for the 2016 period by economic activity.

The 90.90% (n=140) of the companies were micro companies in size, we found also that this kind of companies presented the bigger proportion of closure (TABLE 14).

| Economic activity | Large Company | Medium Company | Micro-company | Small company | Grand Total | Participation by activity |

|---|---|---|---|---|---|---|

| Diagnostic support activities | 12 | 3 | 15 | 9.74% | ||

| Therapeutic support activities | 11 | 2 | 13 | 8.44% | ||

| Social assistance activities without accommodation for the elderly and disabled | 1 | 1 | 0.65% | |||

| Care activities in institutions for the care of the elderly and / or disabled | 1 | 1 | 0.65% | |||

| Residential care activities for the care of patients with mental retardation mental illness and consumption of psychoactive substances | 1 | 1 | 0.65% | |||

| Generalized residential medical care activities | 3 | 3 | 1.95% | |||

| Activities of hospitals and clinics with hospitalization | 1 | 1 | 1 | 3 | 1.95% | |

| Activities of medical practice without hospitalization | 65 | 6 | 71 | 46.10% | ||

| Activities of the dental practice | 18 | 18 | 11.69% | |||

| Other social assistance activities without accommodation | 3 | 3 | 1.95% | |||

| Other activities of human health care | 1 | 23 | 24 | 15.58% | ||

| Other care activities in institutions with accommodation | 1 | 1 | 0.65% | |||

| Grand Total | 1 | 1 | 140 | 12 | 154 | 100% |

Table 14. Registered and updated companies for the 2016 period by economic activity and size

Conclusion

Creation and sustainability of companies are indicators of development and economic growth in a region. In our study we found that, from a global view, companies that did not update their commercial registration were most micro and small companies in size also were the companies that did not update their merchant registry. In addition, companies registered as medium and large maintained had more updates of their mercantile registry without reporting a cessation of activities. Therefore, the smaller the companies are more difficult it becomes to maintain activities over time. Similar behavior was explained for Martínez [30] and Hernández [31] who identified that the small companies have more probabilities of staying actives that other large ones.

We found a direct association between size of the company and economic activity. Activities related to the smaller companies were related to activities of medical practice without hospitalization, dental practice and other related with health care. Similar behavior was found for companies that updated their registries, where the activities that had the most renewal of companies were activities of medical practice without hospitalization, diagnostic support activities and activities of dental practice. In addition, there was a direct association between the type of registered economic activity and the number of companies registered for each of them. Economic activities with less creation of new companies did not present cessation of activities or intermittency in the update of their merchant registry; but for those with high number of new registers presented more closure/cessation of activities. In different way, in Colombia, the level of concession of companies in economic subsectors is related to the probability of survival demonstrating that the companies registered in the sub-sectors with high levels are at greater risk of leaving the market [21-31].

These results have different contributions: for practical of business administration, for economic and management literature and for regional politics decision. Also, this study shows the business landscape of the health sector in a region of southern Colombia, serving as a national and international benchmark and a baseline for future studies.

Our conclusions in this study could help others for carrying out projects, strategies and interventions that encourage the creation of companies and strengthen their sustainability and success in a similar economic environment.

Disclosure

The authors declare no conflict of interest, regarding the publication of this paper.

References

- Barón G. Cuentas de salud de Colombia 1993-2003: el gasto nacional en salud y su financiamiento. Bogotá: Impresol (2007).

- Hernández M. Reforma sanitaria, equidad y derecho a la salud en Colombia. Cadernos de Saúde Pública 18(4), 991-1001 (2002).

- Barón G. Gasto Nacional en Salud de Colombia 1993-2003: Composición y Tendencias. Rev. Salud Pública 9(2), 167-179 (2007).

- Departamento Administrativo Nacional de Estadísticas (DANE). Censo económico. Bogotá (2005).

- Mills D, Timmins J. Firm Dynamics in New Zealand: A Comparative Analysis with OECD Countries. New Zealand treasury working paper 04/11 (2004).

- Johnson P. Targeting Firm Births and Economic Regeneration in a Lagging Region. Small Business Economics, 24(5), 451-464 (2005).

- Franco M, Urbano D. El éxito de las PyMES en Colombia: un estudio de casos en el sector salud. Estudios gerenciales 26(114), 77-97 (2010).

- Bartelsman E, Scarpetta S, Schivardi F. Comparative analysis of firm demographics and survival: micro-level evidence for the OECD countries. Industrial Corporate Change 14(3), 365-391 (2005).

- Santarelli E, Vivarelli M. Entrepreneurship and the process of firms’ entry, survival and growth. Industrial Corporate Change 16(3), 455-488 (2007).

- Highfield R, Smiley R. New Business Starts and Economics Activity. Int. J. Industrial Organization 5(1), 51-66 (1987).

- Audretsch D. New firm survival and the technological regime. Rev. Econ. Stat. 73(3), 441-450 (1991).

- Audretsch D. Innovation, growth and survival. Int. J. Industrial Organization 13(4), 441–457 (1995).

- Cefis E, Marsili O. Innovation premium and the survival of entrepreneurial firms in the Netherlands. Berlin: Springer (2006).

- Holmes P, Hunt A, Stone I. An analysis of new firm survival using a hazard function. App. Econ. 42(2), 185-195 (2010).

- Huggins R, Prokop D, Thompson P. Entrepreneurship and the determinants of firm survival within regions: human capital, growth motivation and locational conditions. Entrepreneurship Reg. Dev. 29(3-4), 357-389 (2017).

- Hall B. The Relationship between firm size and firm growth in the US manufacturing sector. J. Industrial Econ. 35(4), 583-606 (1987).

- Evans D. The relationship between firm growth, size and age: estimates for 100 manufacturing industries. J. Industrial Econ. 35(4), 567-581 (1987).

- Dunne T, Roberts M, Samuelson L. Patterns of Firm Entry and Exit in U.S. Manuacturing Industries. RAND J. Econ. 19(4), 495-515 (1988).

- Bentzen J, Madsen E, Smith V. Do Firms Growth Rates Depend on Firm Size? Small Business Econ. 39(4), 937-947 (2012).

- Barba G, Castellani D, Pieri F. Age and Firm Growth: Evidence from Three European Countries. Small Business Econ. 43(4), 823-837 (2014).

- Hannan M, Carroll G. Dynamics of Organizational Populations. New York: Oxford University Press, 1992.

- Audretsch D, Mahmood T. The Rate of Hazard Confronting New Firms and Plants in US Manufacturing. Rev. Industrial Organization 9(1), 41-56 (1994).

- Levinthal D. Adaptation on Rugged Landscapes. Management Sci. 43(7), 934-950 (1997).

- Rauch A, Rijsdijk S. 2013. The Effects of General and Specific Human Capital on Long-term Growth and Failure of Newly Founded Businesses. Entrepreneurship Th. Pract. 37(4), 923-941 (2013).

- Red de Cámaras de Comercio (Confecámaras). Determinantes de la supervivencia empresarial en Colombia. Bogotá (2017).

- Montoya A, Montoya I, Castellanos O. Situación de la competitividad de las pyme en Colombia: elementos actuales y retos. Agronomía Colombiana 28(1), 107-117 (2010).

- Arias A, Quiroga R. Cese de actividades de las pymes en el área metropolitana de Cali (2000-2004): un análisis de supervivencia empresarial. Cuadernos de Administración 21(35), 249-277 (2008).

- Parra J. Determinantes de la probabilidad de cierre de nuevas empresas en Bogotá. Revista de la facultad de ciencias económicas de la Universidad Militar Nueva Granada 19(1), 27-53 (2011).

- Franco M, Urbano D. El éxito de las PyMES en Colombia: un studio de casos en el sector salud. Estudios gerenciales 26(114), 77-96 (2010).

- Martínez A. Determinantes de la supervivencia de empresas industriales en el área metropolitana de Cali 1994- 2003. Revista Sociedad y Economía 11, 112-144 (2006).

- Hernández C. Supervivencia de las microempresas en el departamento del Magdalena 2009-2012: un enfoque logístico. Perfil de Coyuntura Econ. 22, 197-204 (2013).